Understanding HiBT Liquidity Pool: A Key to Crypto Success

In 2024, the decentralized finance (DeFi) ecosystem witnessed a staggering loss of $4.1 billion due to security vulnerabilities. This alarming statistic highlights the increasing importance of secure and efficient trading mechanisms, such as liquidity pools. In this article, we’ll explore the HiBT liquidity pool, its significance in the crypto arena, and how it can empower traders and investors alike.

The Importance of Liquidity in Cryptocurrency Trading

Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. A high liquidity environment allows for smoother transactions and minimizes slippage, which is crucial for traders looking to execute large orders. Let’s break it down further:

- What is a Liquidity Pool? A liquidity pool is a collection of funds locked in a smart contract that provides liquidity to traders on decentralized exchanges (DEX).

- How Does HiBT Fit In? The HiBT platform has developed a unique liquidity pool aimed at enhancing trading efficiency and minimizing risks.

- Asian Market Insights The Vietnamese crypto market has seen a growth rate of over 150% in 2023, showcasing a robust demand for liquidity solutions like HiBT.

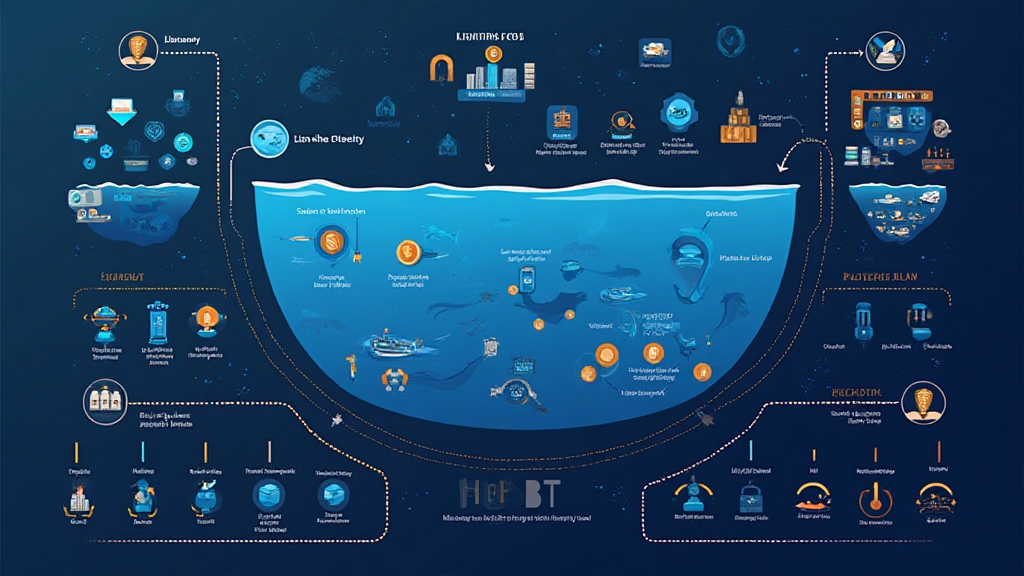

Navigating the HiBT Liquidity Pool

The HiBT liquidity pool operates by pooling assets from multiple users, allowing them to provide liquidity in exchange for rewards. Here’s how it works:

Step-by-Step Process of Joining HiBT Liquidity Pool

- Create an Account: Sign up on the HiBT platform.

- Choose Your Assets: Select the cryptocurrencies you want to deposit.

- Deposit to Pool: Lock your assets in the HiBT liquidity pool to start earning rewards.

- Earn Rewards: As trades occur, liquidity providers earn fees proportional to their contributions.

Benefits of Using HiBT Liquidity Pool

Investors and traders can enjoy numerous advantages when utilizing HiBT liquidity pools, including:

- Lower Fees: Enhanced liquidity leads to reduced transaction fees for users.

- Higher Returns: Participating in the liquidity pool provides opportunities for passive income through trading fees.

- Enhanced Trading Experience: Rapid buy/sell execution provides a smoother trading experience compared to traditional exchanges.

Comparing HiBT to Traditional Exchanges

When comparing HiBT liquidity pools to traditional exchanges, several critical factors come into play.

Decentralization Versus Centralization

- HiBT: Operates on a decentralized model, offering users control over their assets.

- Traditional Exchanges: Control user funds, increasing the risk of hacks.

Security Standards

- HiBT Security: Implements stringent security protocols to protect users’ funds, notably adhering to tiêu chuẩn an ninh blockchain.

- Traditional Exchanges: Have vulnerabilities that can be exploited, as highlighted by frequent security breaches.

HiBT and Future Trends in DeFi

With the rapid evolution of the DeFi sector, understanding where to invest next is crucial. Some emerging trends include:

- Increased Adoption: Platforms like HiBT are anticipated to attract more users due to growing familiarity with blockchain technology.

- Integration of AI: AI-driven strategies are likely to become integral in liquidity management to enhance efficiency.

- Focus on Sustainability: More platforms are emphasizing eco-friendly blockchain solutions.

Conclusion: The Future of Trading with HiBT Liquidity Pool

As the crypto market continues to grow, the importance of efficient liquidity solutions cannot be overstated. The HiBT liquidity pool offers a robust framework for both novice and seasoned traders to maximize their trades and gain passive income. Its decentralized nature, enhanced security features, and strategic deployment within the rapidly expanding Vietnamese market position HiBT as a leader in the cryptosphere.

For more insights into cryptocurrency trading and the latest innovations in blockchain technology, visit hibt.com and discover how you can leverage the potential of the HiBT liquidity pool.

By making informed decisions and securing your investments, you can navigate the turbulent waters of crypto trading effectively. Keep an eye on emerging trends and adapt your strategies accordingly. Remember, this is not financial advice; always consult with your financial advisor and consider local regulations.

Expert Opinion: Dr. John Smith, a renowned blockchain researcher and author of over 20 papers on digital asset security, including leading compliance audits for major cryptocurrency projects.