Introduction

With over $4.1 billion lost in DeFi hacks during 2024, the need for robust governance in the blockchain realm has never been more pressing. As we delve deeper into the variables that influence Decentralized Autonomous Organizations (DAOs), it’s vital to recognize the overarching significance of effective governance models that ensure transparency, security, and user participation. In this article, we will explore various DAO governance models, highlighting their implications for the future of decentralized decision-making in the crypto space.

Understanding DAO Governance Models

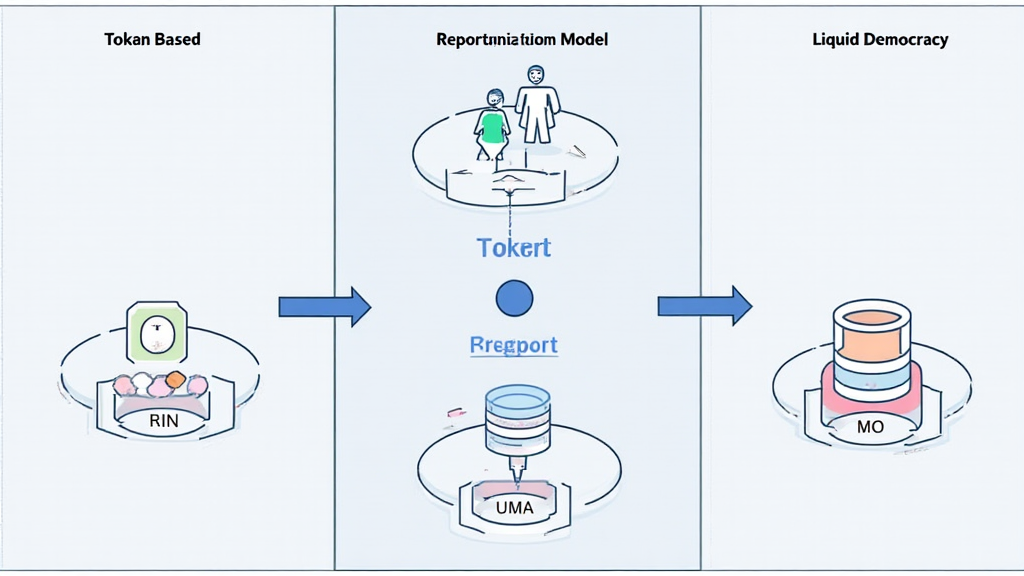

DAO governance models dictate how decisions are made within a decentralized organization. They set the framework for decision-making processes, stakeholder engagement, and resource allocation. At the core of these models lies the belief that decentralization minimizes risks associated with centralized authority. Some prominent DAO governance models include:

- Token-Based Governance

- Reputation-Based Governance

- Liquid Democracy

Token-Based Governance

One of the most common models is token-based governance, where participants use tokens to vote on proposals. Each token typically represents one vote, giving more influence to those who hold more tokens. For example, in popular DAOs like MakerDAO, token holders vote on critical issues, such as changes to the DAI stablecoin protocol.

Pros and Cons

- Pros: Encourages investment in the platform as token holders can influence its future.

- Cons: This model may lead to token centralization, where a small number of holders have significant power, compromising the democratic nature.

Reputation-Based Governance

In this model, voting power is based on a user’s reputation within the ecosystem. Users earn reputation through their activities, contributions, or participation in discussions. DAOs like Gitcoin utilize this model to prioritize the insights of seasoned contributors.

Advantages and Challenges

- Advantages: Reduces the risk of whales dominating decision-making processes.

- Challenges: Establishing a fair system for reputation assessment can be complex.

Liquid Democracy

Liquid democracy is a hybrid approach where voters can delegate their voting power to other trusted representatives, allowing for a balance of direct and representative democracy. This model empowers users to retain control over their votes while enabling expertise-driven decision-making in complex matters.

Strengths and Limitations

- Strengths: Offers flexibility and encourages active participation.

- Limitations: May still yield complexities in managing delegated power.

Real-World Applications: What Works Best?

As we analyze the effectiveness of these governance models in practice, certain trends emerge across diverse DAOs.

- Example 1: Uniswap – Token-based governance has enabled users to vote on liquidity incentives and protocol upgrades.

- Example 2: Aragon – Embracing reputation-based models fosters a collaborative environment for users.

- Example 3: DAOstack – Liquid democracy fuels decentralized decision-making in resource allocations.

These examples illustrate how different governance structures shape unique community dynamics, directly impacting the DAO’s effectiveness.

Analysis of Vietnamese Market Statistics

The DAO landscape is rapidly evolving in Vietnam, with user growth rates projected to exceed 30% in the upcoming years, largely attributed to increasing participation in DeFi and NFTs. The necessity for effective governance models will only amplify as more Vietnamese users join the digital asset ecosystem.

Implications for Vietnamese Users

- Awareness: Understanding governance structures can empower users to participate better.

- Security: Knowledge of potential risks and vulnerabilities tied to different governance models is critical.

Future Trends in DAO Governance

Looking forward, several trends are anticipated in DAO governance:

- Enhanced Transparency: Advanced auditing mechanisms will emerge to ensure accountability.

- Integration of AI: Streamlining governance processes through AI tools can improve decision-making.

Additional Resources

For more details on governance structures, consider visiting hibt.com for insights on smart contract auditing and decentralized governance principles.

Conclusion

Understanding the various DAO governance models is crucial in today’s rapidly changing crypto landscape. By exploring these frameworks, users can make informed decisions about where to allocate their assets and how to engage with decentralized systems. Effective governance not only enhances security and transparency but also facilitates sustainable growth in the digital economy. Stay informed to navigate the complexities of DAO governance models efficiently.

As we embrace these innovations, tools like cryptocoincompare can offer insights and updates on developments within the crypto ecosystem.

Author: Dr. Nguyen Pham – A blockchain researcher with over 15 published papers, Dr. Pham specializes in decentralized systems and has led audits for several prominent crypto projects, ensuring security and compliance in a rapidly changing environment.